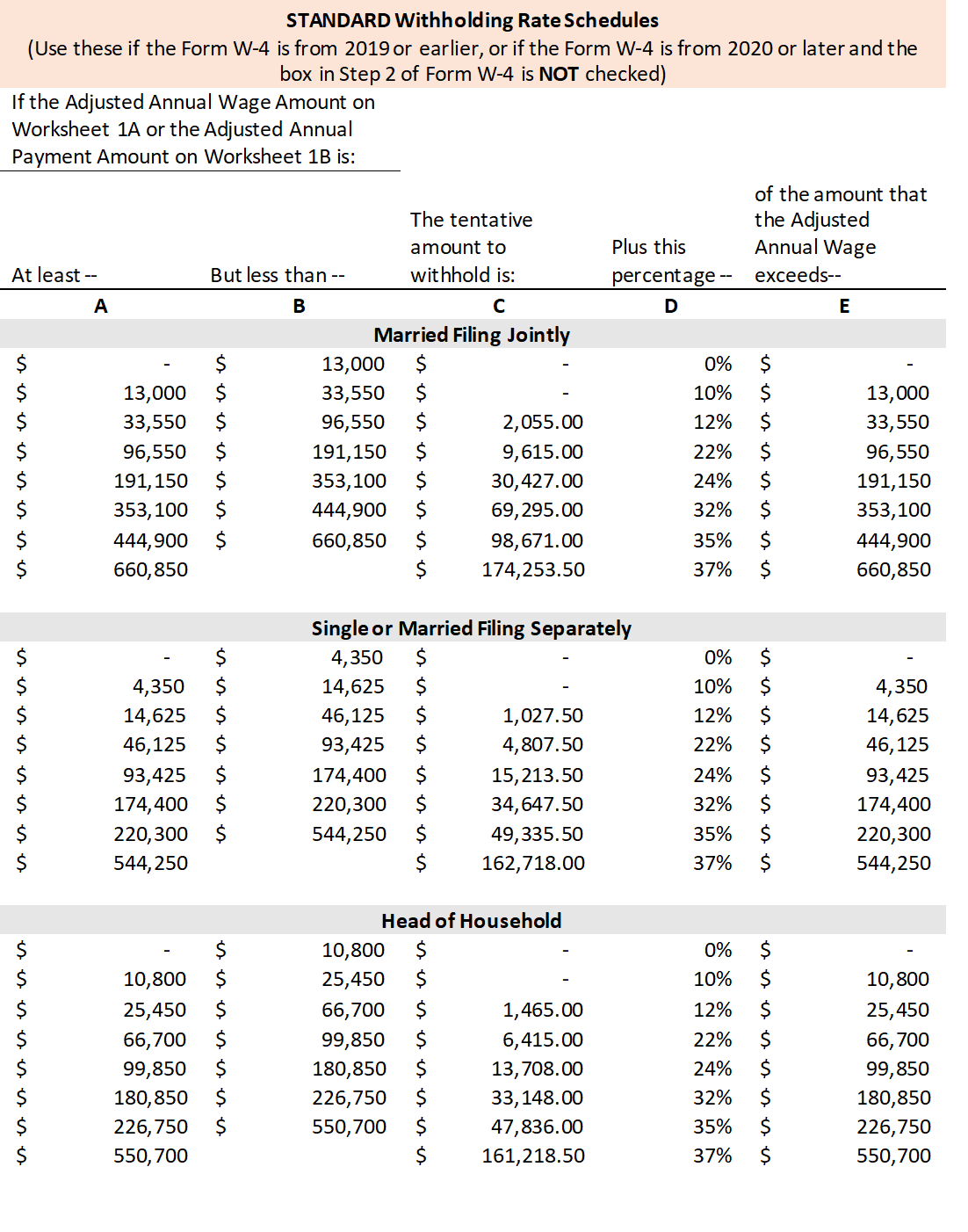

Estimate 2025 Tax Withholding. Federal income tax rates range from 10% up to a top marginal rate of 37%. The 2025 standard deductions and 2025 tax brackets have been added.

You will need to provide the calculator with basic information about yourself. Estimated tax payments are taxes paid to the irs throughout the year on earnings that are not subject to federal tax withholding.

Us tax calculator 2025 [for 2025 tax return] this tool is designed to assist with calculations for the 2025 tax return and forecasting for the 2025 tax year.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Generally, a fiduciary of an estate or trust must pay estimated tax if the estate or trust is expected to owe at least $1,000 in tax for 2025 and can expect its withholding. For example, if you plan to make $40,000 in ira distributions and have $20,000 in social security income with the standard deduction, your taxes owed will be.

IRS Estimated Taxes Tax Withholding Estimator 2025, The irs received 162,037,000 individual income tax returns in 2025. The tax withholding calculator is made up of five different parts.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, For example, if you plan to make $40,000 in ira distributions and have $20,000 in social security income with the standard deduction, your taxes owed will be. Real median household income (adjusted for inflation) in.

Withholding Tables Calculator, Estimated tax payments are the taxes you pay to the irs throughout the year to account for income you've earned that wasn't subject to tax withholding. Answer a few simple questions.

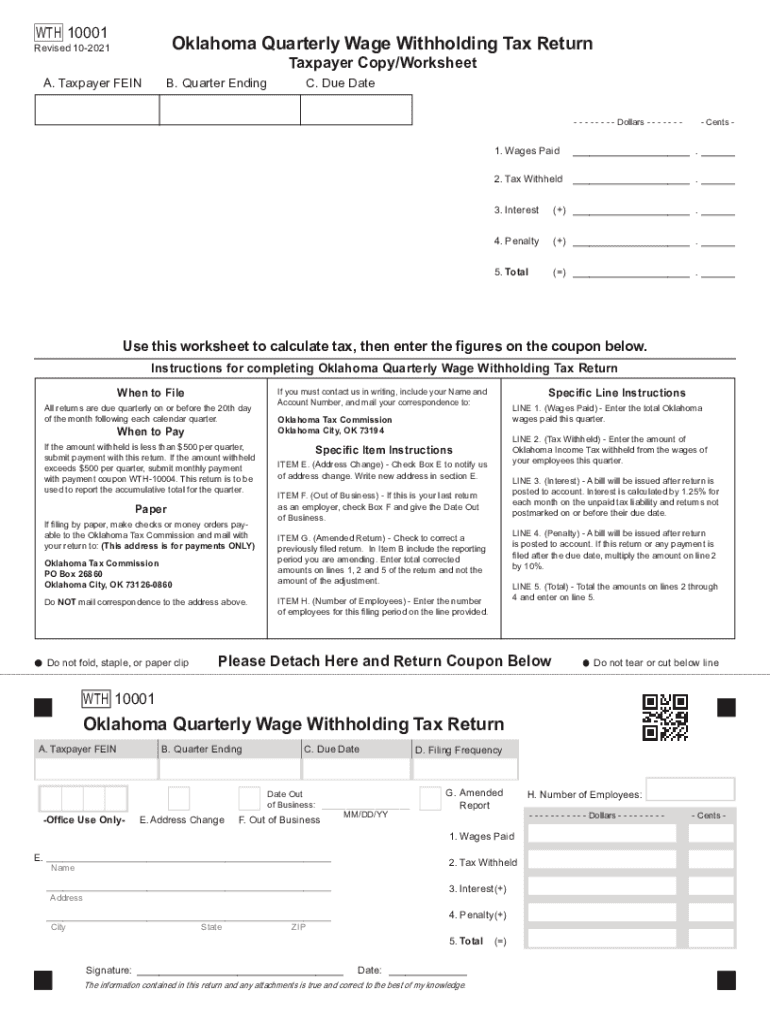

Oklahoma Quarterly Wage Withholding Tax Return 20212024 Form Fill, Tax forms | tax codes. Estimated tax payments are the taxes you pay to the irs throughout the year to account for income you've earned that wasn't subject to tax withholding.

Irs New Tax Brackets 2025 Elene Hedvige, Use this worksheet to figure the amount of your projected withholding for 2025, compare it to your projected tax for 2025, and, if necessary, figure any adjustment to the amount you have withheld each payday. For example, if you plan to make $40,000 in ira distributions and have $20,000 in social security income with the standard deduction, your taxes owed will be.

Tax rates for the 2025 year of assessment Just One Lap, Washington — the internal revenue service today suggested taxpayers who filed or are about to file their 2025 tax return use the irs tax withholding estimator. Real median household income (adjusted for inflation) in.

1040 Schedule A 2025 Tax Klara Michell, About your life and income. To do this, send a completed request to review ato initiated payg withholding cycle change form to us within 21 days of receiving our letter.

Tax Withholding Calculator 2025 Federal Tax Zrivo, Credits, deductions and income reported on other forms or schedules. The tax underpayment penalty is based on the amount you underpaid, the lateness of the payment, and the irs’ interest rate.

Federal withholding calculator 2025 FloraidhJai, Answer a few simple questions. Estimated tax payments are the taxes you pay to the irs throughout the year to account for income you've earned that wasn't subject to tax withholding.

Estimated tax payments are the taxes you pay to the irs throughout the year to account for income you've earned that wasn't subject to tax withholding.