Irs Tax Tables For 2025 Tax Year. There are seven tax brackets for most ordinary income for the 2025 tax year: The highest earners fall into the 37% range,.

As your income rises it can push you into a higher tax bracket and may. Here’s a look at the projected numbers for the tax year 2025, beginning jan.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, Page last reviewed or updated: However, for the 2025 tax year (taxes filed in.

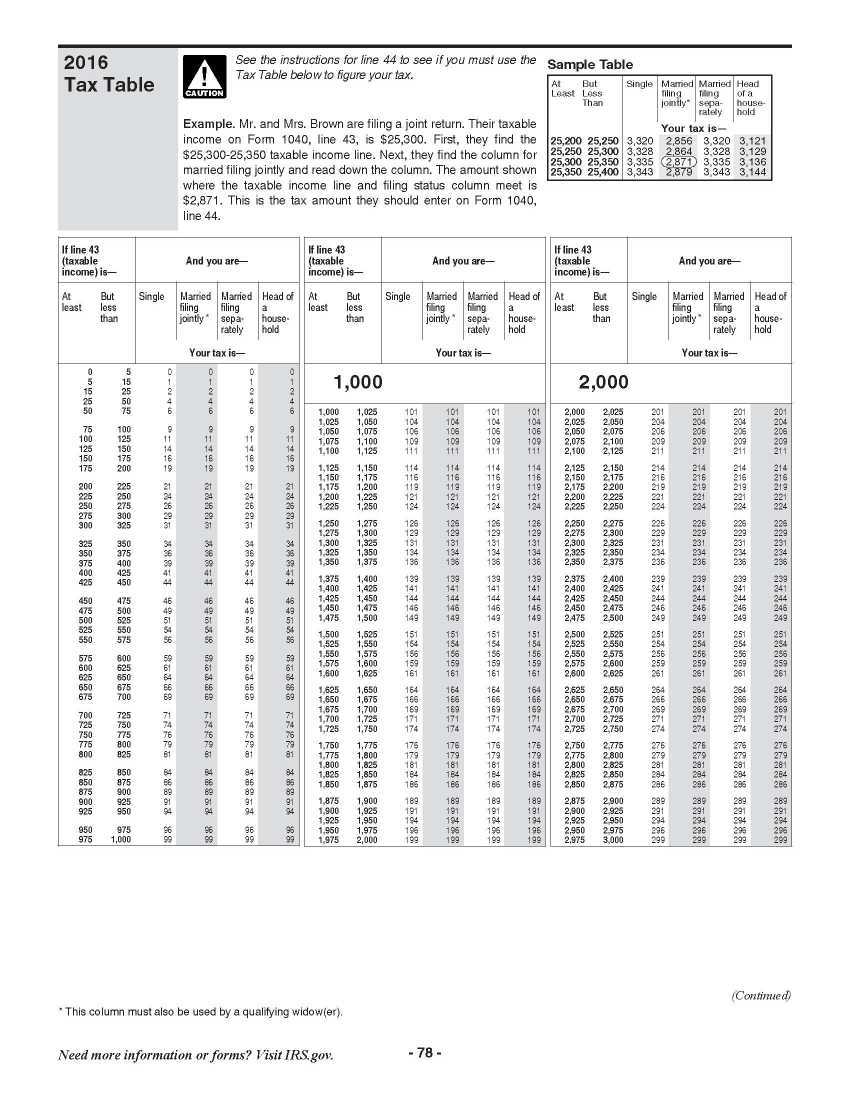

Irs Ez Tax Table 2025 2025 Eduvark Hot Sex Picture, The irs uses 7 brackets to calculate your tax bill based on your income and filing status. Social security and medicare tax for 2025.

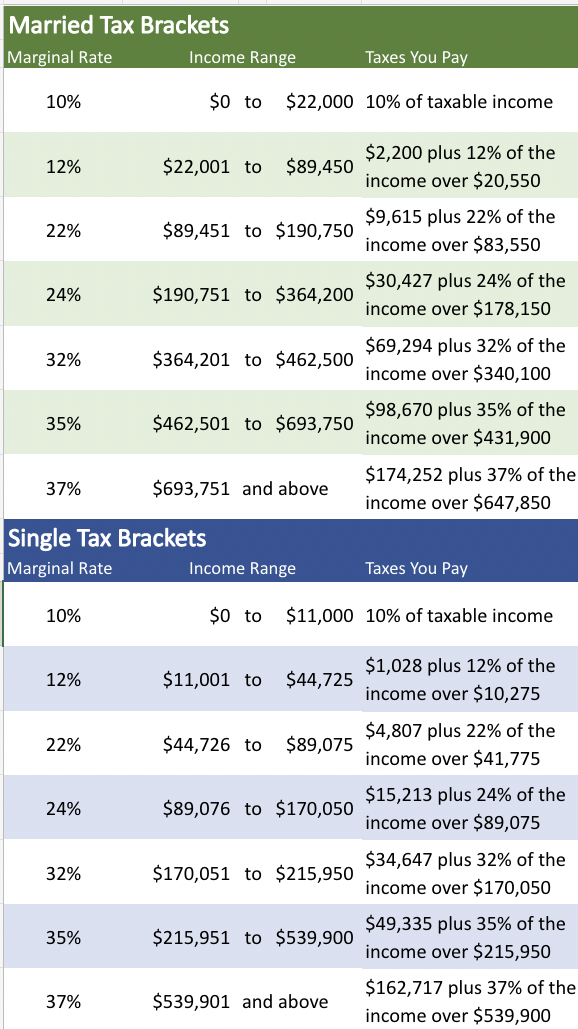

2025 Tax Brackets For Seniors Jaime Blondelle, Social security and medicare tax for 2025. The marginal rates — 10%, 12%, 22%, 24%, 32%, 35% and 37% — remain unchanged from 2025.

Oct 19 Irs Here Are The New Tax Brackets For 2025 Free Nude, Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2025 • january 12, 2025 1:38 pm. Swipe to scroll horizontally 2025 tax brackets:

Irs Tax Filing 2025 Sadie Collette, However, for the 2025 tax year (taxes filed in. There are seven tax brackets for most ordinary income for the 2025 tax year:

Irs Withholding Rates 2025 Federal Withholding Tables 2025, As your income rises it can push you into a higher tax bracket and may. The seven federal income tax brackets for 2025 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

How to Calculate Payroll Taxes for Your Small Business, Here are the new 2025 standard deduction amounts, according to bloomberg tax's forecast: 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

IRS 2025 Tax Tables, Deductions, & Exemptions — purposeful.finance, Your bracket depends on your taxable income and filing status. See current federal tax brackets and rates based on your income and filing status.

Irs Tax Brackets 2025 Chart Printable Forms Free Online, Here are the new 2025 standard deduction amounts, according to bloomberg tax's forecast: The seven federal income tax brackets for 2025 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Tax rates for the 2025 year of assessment Just One Lap, The social security wage base limit is. The rate of social security tax on taxable wages is 6.2% each for the employer and employee.

2025 tax brackets (taxes due in april 2025) the 2025 tax year, and the return due in 2025, will continue with these seven federal tax brackets: